Demystifying the Loan Process: A Comprehensive Guide

Demystifying the loan process can be incredibly helpful for anyone considering borrowing m...

10 Essential Tips for Getting Approved for a Loan

Getting approved for a loan can be a critical step in achieving your financial goals. Here...

Types of Loans: Choosing the Right One for You

Choosing the right type of loan is crucial to meet your specific financial needs. Here are...

How to Improve Your Credit Score for Better Loan Rates

Improving your credit score is a great way to secure better loan rates and terms. Here are...

The Pros and Cons of Personal Loans

Personal loans can be a versatile financial tool, but they come with their own set of adva...

Mortgage 101: Everything You Need to Know

Mortgages are complex financial instruments, but understanding the basics is crucial for a...

Small Business Loans: Navigating the Application Process

Navigating the small business loan application process requires careful planning and prepa...

Understanding Interest Rates: Fixed vs. Variable

Understanding the difference between fixed and variable interest rates is crucial when it...

Secured vs. Unsecured Loans: What's the Difference?

Secured and unsecured loans are two distinct types of borrowing, each with its own set of...

5 Common Mistakes to Avoid When Applying for a Loan

When applying for a loan, it's important to approach the process with care and attention t...

The Role of Collateral in Securing a Loan

Collateral plays a crucial role in securing a loan. It serves as a form of security for th...

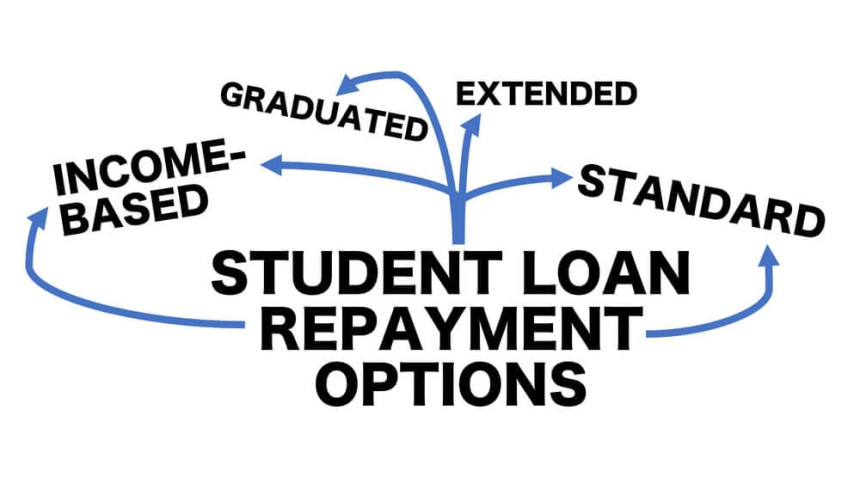

Student Loans: Repayment Strategies and Forgiveness Programs

Managing student loans effectively involves understanding various repayment strategies and...

The ABCs of Auto Loans: Tips for a Smoother Process

Navigating the process of obtaining an auto loan can be simplified by following these ABCs...

How to Spot Predatory Lending Practices

Spotting predatory lending practices is crucial to protect yourself from potentially harmf...

Home Equity Loans vs. Home Equity Lines of Credit

Home equity loans and home equity lines of credit (HELOCs) are both types of loans that al...

Navigating the World of Business Credit: Loans and Lines of Credit

Navigating the world of business credit, including loans and lines of credit, requires car...

Loan Terms and Jargon Explained for Beginners

Understanding loan terms and jargon is crucial when navigating the world of borrowing. Her...

Emergency Loans: What to Do When You Need Quick Cash

When facing a financial emergency, it's important to consider your options carefully to se...

The Impact of Debt-to-Income Ratio on Loan Approvals

The debt-to-income ratio (DTI) is a critical factor that lenders consider when evaluating...

Tips for Negotiating Loan Terms with Lenders

Negotiating loan terms with lenders can help you secure more favorable terms and potential...

SBA Loans: A Comprehensive Guide for Small Business Owners

Small Business Administration (SBA) loans are government-backed loans designed to support...

The Hidden Costs of Taking Out a Loan

Taking out a loan can come with more costs than just the interest rate. It's important to...

Alternative Lending Options: Exploring Beyond Traditional Banks

Exploring alternative lending options can provide additional avenues for securing financin...

How to Create a Solid Loan Repayment Plan

Creating a solid loan repayment plan is essential for managing your debt responsibly and e...

Understanding Loan Origination Fees and Closing Costs

Loan origination fees and closing costs are important components of the overall cost of a...

FHA, VA, and Conventional Loans: Which is Right for You?

Choosing between FHA, VA, and conventional loans depends on your specific circumstances, i...

The Link Between Credit History and Loan Approval

Your credit history plays a crucial role in the loan approval process. Lenders use your cr...

Peer-to-Peer Lending: A New Frontier in Borrowing

Peer-to-peer (P2P) lending, also known as person-to-person lending or social lending, is a...

The Art of Building a Loan-Worthy Financial Profile

Building a loan-worthy financial profile is essential for securing favorable terms and rat...