Home Equity Loans vs. Home Equity Lines of Credit

Home equity loans and home equity lines of credit (HELOCs) are both types of loans that allow homeowners to borrow against the equity they have built up in their homes. However, they work differently and have distinct characteristics. Here's a comparison of home equity loans and HELOCs:

Home equity loans and home equity lines of credit (HELOCs) are both types of loans that allow homeowners to borrow against the equity they have built up in their homes. However, they work differently and have distinct characteristics. Here's a comparison of home equity loans and HELOCs:

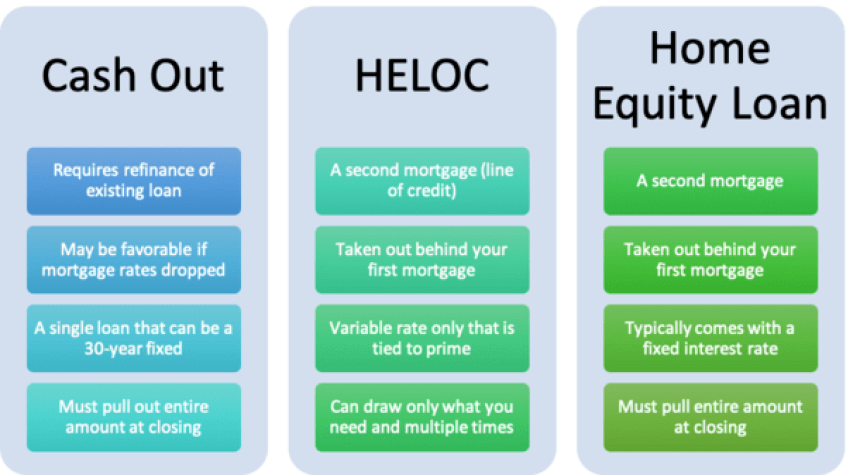

Home Equity Loan:What is a Home Equity Loan?

A home equity loan, also known as a second mortgage, is a lump-sum loan that is borrowed against the equity in your home. The equity is determined by the current market value of your home minus the remaining balance on your mortgage.

Characteristics of a Home Equity Loan:

- Fixed Interest Rate: Home equity loans typically come with a fixed interest rate, meaning your monthly payments remain consistent throughout the life of the loan.

- Lump-Sum Disbursement: You receive the entire loan amount in a lump sum upfront, which you repay over a set term.

- Fixed Repayment Term: Home equity loans have a predetermined repayment period, often ranging from 5 to 30 years.

- Use of Funds: Borrowers can use the funds for specific purposes, such as home improvements, debt consolidation, education expenses, or other major expenses.

- Secured by Your Home: The loan is secured by your home, meaning that if you fail to repay, the lender can take possession of your property through foreclosure.

Home Equity Line of Credit (HELOC):What is a HELOC?

A HELOC is a revolving line of credit that allows you to borrow against the equity in your home up to a certain limit. It operates similar to a credit card, where you can borrow, repay, and borrow again up to the established credit limit.

Characteristics of a HELOC:

- Variable Interest Rate: HELOCs typically come with a variable interest rate, which means your monthly payments can fluctuate based on changes in market interest rates.

- Draw Period and Repayment Period: HELOCs have two phases - the draw period (usually 5 to 10 years) where you can borrow funds, and the repayment period (usually 10 to 20 years) where you start repaying the borrowed amount.

- Access to Funds: You can access funds from your HELOC as needed, up to the approved credit limit, during the draw period.

- Interest-Only Payments (during draw period): Some HELOCs allow you to make interest-only payments during the draw period, which can result in lower initial monthly payments.

- Secured by Your Home: Like a home equity loan, a HELOC is secured by your home. Failure to repay could lead to foreclosure.

Choosing Between a Home Equity Loan and a HELOC:Consider a Home Equity Loan If:

- You need a lump sum of money for a specific purpose with fixed monthly payments.

- You prefer the stability of a fixed interest rate.

- You have a clear plan for using the funds and want to receive the full amount upfront.

Consider a HELOC If:

- You need access to funds over a period of time and want the flexibility to borrow as needed.

- You're comfortable with a variable interest rate and understand potential payment fluctuations.

- You have ongoing expenses or projects that may require multiple withdrawals over time.

Remember, both home equity loans and HELOCs use your home as collateral, so it's crucial to borrow responsibly and ensure you can comfortably repay the loan or line of credit. It's recommended to compare offers from different lenders and carefully review the terms and conditions before making a decision. Consulting a financial advisor can also provide valuable insights based on your specific financial situation.