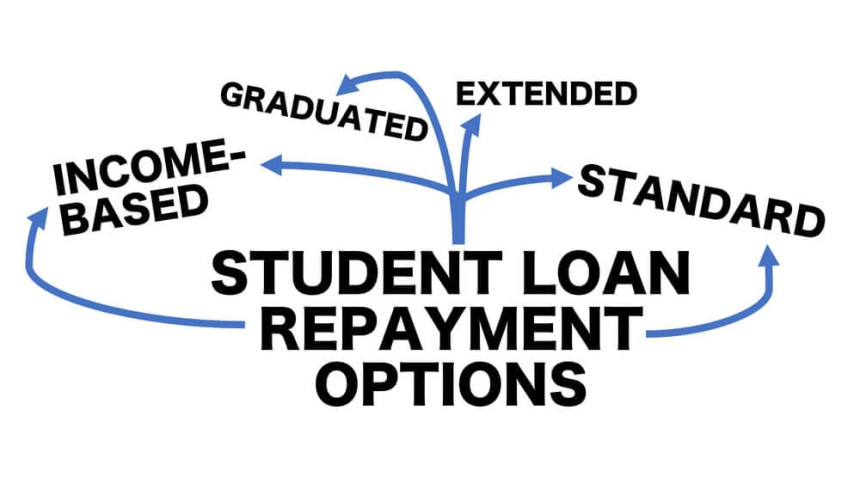

Student Loans: Repayment Strategies and Forgiveness Programs

Managing student loans effectively involves understanding various repayment strategies and potential forgiveness programs. Here are some key considerations for handling student loan debt:

Repayment Strategies:1. Standard Repayment Plan:

- Description: Fixed monthly payments over a 10-year period.

- Pros: Clear timeline for payoff, potentially lower overall interest.

- Cons: Higher monthly payments compared to other plans.

2. Graduated Repayment Plan:

- Description: Payments start low and increase every two years over a 10-year period.

- Pros: Provides lower initial payments for recent graduates.

- Cons: Total interest paid over the life of the loan may be higher.

3. Income-Driven Repayment Plans (IDR):

- Description: Monthly payments are based on income and family size.

- Types of IDR Plans:Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

- Pros: Potentially lower payments, forgiveness options after a certain period.

- Cons: Extended repayment term, potential tax implications if loan is forgiven.

4. Extended Repayment Plan:

- Description: Allows borrowers to extend the repayment period to 25 years.

- Pros: Lowers monthly payments.

- Cons: Higher overall interest paid over time.

5. Loan Consolidation:

- Description: Combines multiple federal loans into a single loan with a weighted average interest rate.

- Pros: Simplifies loan management, may provide access to certain repayment plans.

- Cons: May lose benefits of specific loan programs, potentially longer repayment term.

Forgiveness and Discharge Programs:1. Public Service Loan Forgiveness (PSLF):

- Eligibility: Work full-time for a qualifying employer (e.g., government or non-profit) while making 120 qualifying payments.

- Benefits: Remaining loan balance is forgiven after meeting requirements.

2. Teacher Loan Forgiveness:

- Eligibility: Full-time teacher in a low-income school for five consecutive years.

- Benefits: Up to $17,500 in loan forgiveness for eligible federal loans.

3. Income-Driven Repayment Plan Forgiveness:

- Eligibility: After 20-25 years of qualifying payments, the remaining balance is forgiven (taxable).

- Benefit: Potential forgiveness for borrowers with high debt relative to income.

4. Military Service Loan Forgiveness:

- Eligibility: Various programs available for service members, veterans, and certain military occupations.

- Benefits: Loan forgiveness or repayment assistance based on specific military service.

5. Total and Permanent Disability Discharge:

- Eligibility: Unable to work due to a total and permanent disability.

- Benefits: Loan is discharged, and no further payments are required.

6. Closed School Discharge, Borrower Defense to Repayment, and more:

- Eligibility: Various programs for specific situations (e.g., school closure, fraudulent practices).

- Benefits: Potential loan discharge or forgiveness.

Important Considerations:

- Stay Informed: Understand the terms and conditions of your loans, and keep up with any changes in federal or state loan programs.

- Certify Your Employment: If pursuing PSLF, ensure you complete the Employment Certification Form annually to track progress.

- Consider Tax Implications: Forgiveness or discharge of loans may be considered taxable income, so plan accordingly.

- Explore Loan Repayment Assistance Programs (LRAPs): Some employers or states offer assistance with student loan repayment as a benefit.

- Seek Professional Advice: If you're uncertain about your repayment options or eligibility for forgiveness programs, consider consulting a financial advisor or loan specialist.

Remember, each borrower's situation is unique, and the best approach to managing student loans will depend on factors like income, career goals, and total debt. It's important to carefully evaluate your options and choose a strategy that aligns with your financial circumstances.