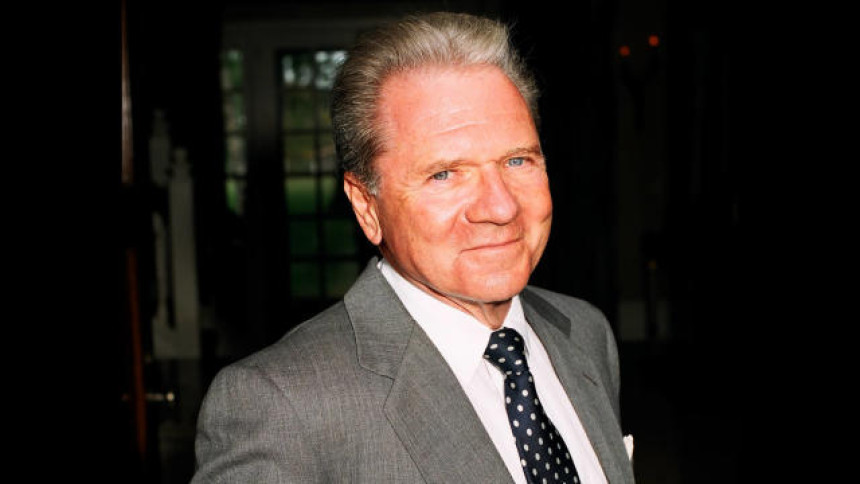

Thomas Peterffy Net Worth and Success Story

Thomas Peterffy is a Hungarian-American entrepreneur and billionaire who founded Interactive Brokers, a leading global electronic brokerage firm. His story is one of resilience, innovation, and the pursuit of excellence. From escaping communist Hungary to revolutionizing the financial industry with electronic trading, Peterffy’s journey is a testament to the power of determination and vision. This comprehensive exploration delves into Thomas Peterffy's net worth, his remarkable personal and professional journey, and his impact on the world of finance.

Early Life and Background

Escape from Hungary

Thomas Peterffy was born on September 30, 1944, in Budapest, Hungary. Growing up in post-World War II Hungary, he experienced the harsh realities of life under a communist regime. In 1965, at the age of 21, Peterffy escaped Hungary and emigrated to the United States, seeking freedom and opportunities unavailable in his homeland.

Starting from Scratch in America

Arriving in New York City with little money and limited English skills, Peterffy worked various odd jobs to make ends meet. He soon enrolled in classes to improve his English and studied engineering at New York University, working tirelessly to build a new life from the ground up. His background in engineering would later prove invaluable in his future endeavors in the financial sector.

Entry into the Financial World

Early Career in Finance

In the early 1970s, Peterffy began his career in finance as a programmer at a company called Mocatta Metals. His engineering skills quickly set him apart, and he was soon recruited by a major Wall Street firm, where he worked on developing software for financial applications. This experience gave Peterffy a unique perspective on the intersection of technology and finance.

Innovative Ideas

While working on Wall Street, Peterffy recognized the potential for technology to transform the trading industry. He envisioned a future where electronic trading could replace the traditional open outcry system, making trading faster, more efficient, and more accessible. This vision would become the foundation of his future success.

Founding Interactive Brokers

T.P. & Co.

In 1977, Peterffy took a bold step by purchasing a seat on the American Stock Exchange and founding his own trading firm, T.P. & Co. Initially, the firm focused on options market making, but Peterffy's innovative approach to trading soon set it apart from competitors. He began using his programming skills to develop proprietary software that automated various aspects of the trading process.

Creation of the First Handheld Computers for Trading

One of Peterffy’s most significant innovations was the development of the first handheld computers for trading. In the early 1980s, he and his team created portable devices that allowed traders to calculate prices and execute trades on the exchange floor with unprecedented speed and accuracy. This technology gave T.P. & Co. a significant competitive edge and demonstrated the transformative potential of electronic trading.

Revolutionizing the Trading Industry

Formation of Interactive Brokers

In 1993, Peterffy rebranded his firm as Interactive Brokers and shifted its focus to providing electronic brokerage services to institutional and retail investors. The company’s mission was to leverage technology to offer low-cost, high-speed trading across a wide range of financial instruments and global markets. Under Peterffy’s leadership, Interactive Brokers quickly grew into one of the most innovative and successful brokerage firms in the industry.

Pioneering Electronic Trading

Interactive Brokers pioneered many of the technologies and practices that are now standard in the trading industry. The firm developed a fully automated trading platform that allowed clients to trade stocks, options, futures, and other securities electronically. This platform provided real-time market data, advanced trading tools, and low commissions, revolutionizing the way investors accessed financial markets.

Commitment to Low Costs and Transparency

Peterffy's commitment to transparency and low costs became a hallmark of Interactive Brokers. By automating trading processes and eliminating unnecessary middlemen, the firm was able to offer some of the lowest commissions in the industry. This approach attracted a growing number of clients, from individual traders to large institutional investors, who valued the combination of cutting-edge technology and cost-effective trading solutions.

Achievements and Milestones

Public Offering and Expansion

In 2007, Interactive Brokers went public, raising $1.2 billion in its initial public offering (IPO). The IPO was a significant milestone for the company, providing the capital needed to expand its global reach and further develop its technology. Over the years, Interactive Brokers continued to grow, opening offices in major financial centers around the world and expanding its product offerings to include a wide range of financial instruments.

Industry Recognition

Under Peterffy’s leadership, Interactive Brokers received numerous accolades and industry awards. The firm was consistently ranked as one of the top online brokers for its technology, trading tools, and low costs. Peterffy himself was recognized as a visionary leader in the financial industry, receiving honors such as the Ernst & Young Entrepreneur of the Year Award and being inducted into the Futures Industry Association’s Hall of Fame.

Net Worth and Financial Success

Accumulating Wealth

As of 2024, Thomas Peterffy's net worth is estimated to be around $25 billion, making him one of the wealthiest individuals in the world. His wealth is primarily derived from his substantial ownership stake in Interactive Brokers, which has grown significantly in value over the years. Peterffy’s success is a testament to his innovative approach to trading and his ability to anticipate and capitalize on industry trends.

Philanthropic Efforts

Despite his immense wealth, Peterffy is known for his modest lifestyle and commitment to philanthropy. He has donated millions of dollars to various causes, particularly those related to education, healthcare, and the arts. Peterffy’s philanthropic efforts reflect his belief in the importance of giving back and making a positive impact on society.

Leadership Style and Business Philosophy

Visionary Leadership

Thomas Peterffy’s leadership style is characterized by his visionary thinking and hands-on approach. He is deeply involved in the strategic direction of Interactive Brokers, continually pushing the firm to innovate and stay ahead of the competition. Peterffy’s ability to anticipate market trends and leverage technology has been a key driver of the company’s success.

Focus on Technology and Efficiency

Peterffy’s engineering background has profoundly influenced his business philosophy. He places a strong emphasis on technology and efficiency, constantly seeking ways to improve processes and reduce costs. This focus on innovation has enabled Interactive Brokers to maintain its competitive edge and offer clients industry-leading trading solutions.

Commitment to Integrity and Transparency

Integrity and transparency are core values for Peterffy and Interactive Brokers. The firm is known for its clear and straightforward pricing, with no hidden fees or conflicts of interest. Peterffy’s commitment to these principles has helped build trust with clients and establish Interactive Brokers as a respected leader in the financial industry.

Challenges and Controversies

Navigating Market Turbulence

Like any successful entrepreneur, Thomas Peterffy has faced his share of challenges and controversies. Interactive Brokers has had to navigate periods of significant market turbulence, such as the 2008 financial crisis and the 2020 COVID-19 pandemic. Despite these challenges, Peterffy’s focus on risk management and technological innovation has enabled the firm to weather the storms and continue its growth trajectory.

Regulatory Scrutiny

As a major player in the financial industry, Interactive Brokers has faced regulatory scrutiny over the years. The firm has been involved in various legal and regulatory challenges, including allegations of market manipulation and compliance issues. However, Peterffy and his team have consistently worked to address these challenges and maintain the firm’s reputation for integrity and transparency.

Legacy and Future Prospects

Impact on the Financial Industry

Thomas Peterffy’s impact on the financial industry extends far beyond Interactive Brokers. He is widely regarded as a pioneer of electronic trading, and his innovations have transformed the way financial markets operate. Peterffy’s commitment to technology and efficiency has set new standards for the industry, influencing the practices of brokers and traders around the world.

Future Growth and Innovation

Looking ahead, Interactive Brokers is well-positioned for continued growth and innovation. Peterffy’s focus on technology and cost efficiency will remain key drivers of the firm’s success. As new opportunities and challenges arise in the financial markets, Interactive Brokers is poised to adapt and thrive, maintaining its status as a leading global brokerage firm.

Philanthropic Legacy

Peterffy’s philanthropic efforts will also leave a lasting legacy. His contributions to education, healthcare, and the arts reflect his commitment to making a positive impact on society. By supporting initiatives that promote knowledge, well-being, and cultural enrichment, Peterffy’s philanthropy will benefit future generations and help create a better world.

Conclusion

Thomas Peterffy’s success story is a remarkable tale of resilience, innovation, and vision. From his early days in communist Hungary to founding one of the world’s leading electronic brokerage firms, Peterffy’s journey is characterized by a relentless pursuit of excellence and a commitment to leveraging technology for positive change. His net worth, reflective of Interactive Brokers’ immense value, underscores his achievements in the financial industry.

Despite his immense wealth, Peterffy has remained committed to giving back through his extensive philanthropic efforts. His contributions to education, healthcare, and the arts have made a significant impact on society, reflecting his belief in the importance of using wealth to effect positive change.

In summary, Thomas Peterffy’s story is a testament to the power of vision, innovation, and a deep understanding of the financial markets. His ability to navigate the complexities of the financial world while maintaining a commitment to excellence and philanthropy is a unique and compelling narrative, making him one of the most influential figures in the global business landscape.