Loans for Specific Needs: Education, Home Improvement, and More

Certainly! There are various types of loans tailored to specific needs. Here are some common types:

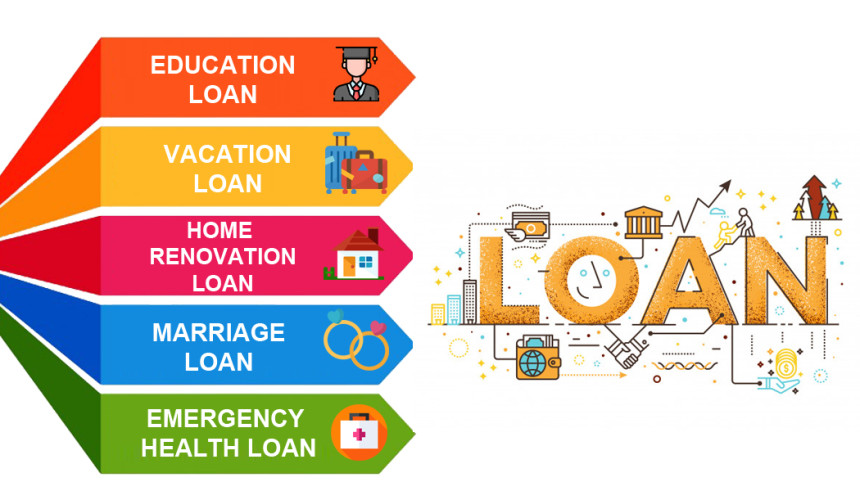

1. Student Loans:

- Purpose: Covering educational expenses like tuition, books, and living costs for college or vocational education.

- Features: Usually offered at lower interest rates with flexible repayment terms. Federal and private student loans are available.

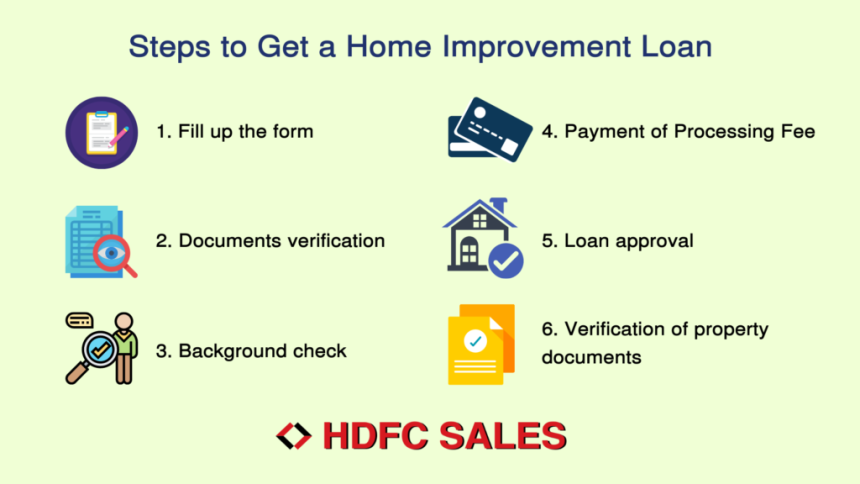

2. Home Improvement Loans:

- Purpose: Funding renovations, repairs, or improvements to a home.

- Features: Options include home equity loans, home equity lines of credit (HELOCs), and personal loans. Interest rates may vary based on the chosen loan type.

3. Auto Loans:

- Purpose: Financing the purchase of a vehicle.

- Features: Terms vary, with options for new and used cars. Interest rates may be fixed or variable depending on the lender and borrower's creditworthiness.

4. Mortgages:

- Purpose: Purchasing a home or refinancing an existing mortgage.

- Features: Various types (e.g., fixed-rate, adjustable-rate, FHA, VA) with different terms and down payment requirements.

5. Personal Loans:

- Purpose: Unsecured loans for various purposes (e.g., debt consolidation, medical expenses, travel).

- Features: Fixed or variable interest rates, shorter repayment terms compared to other loans.

6. Business Loans:

- Purpose: Funding for business operations, expansion, or specific projects.

- Features: Various types, including term loans, lines of credit, and SBA loans, tailored to different business needs.

7. Debt Consolidation Loans:

- Purpose: Combining multiple debts into a single, more manageable loan.

- Features: Helps simplify repayments and may lead to lower overall interest costs, especially if the new loan has a lower interest rate.

8. Medical or Healthcare Loans:

- Purpose: Covering medical expenses, treatments, or procedures not fully covered by insurance.

- Features: May offer special financing options for specific medical procedures or services.

9. Vacation Loans:

- Purpose: Financing a vacation or travel expenses.

- Features: Personal loans designed for travel-related expenses, often with fixed interest rates.

10. Wedding Loans:

- Purpose: Covering wedding-related expenses like venue, catering, attire, etc.

- Features: Personal loans designed specifically for wedding costs.

11. Green Loans:

- Purpose: Financing environmentally-friendly home improvements, such as solar panel installations or energy-efficient upgrades.

- Features: Offered by some lenders with special terms or incentives for eco-friendly projects.

12. Specialty Loans (e.g., Adoption Loans, Adoption Credit Loans, Fertility Loans):

- Purpose: Financial assistance for specific life events or circumstances (e.g., adopting a child, fertility treatments).

- Features: Tailored loans designed to help individuals or families navigate unique situations.

When considering a loan for a specific need, it's important to carefully review the terms, interest rates, fees, and repayment options offered by different lenders. Additionally, borrowers should assess their own financial situation and ensure they have a clear plan for repaying the loan. Consulting with a financial advisor can provide valuable guidance on selecting the right loan for your specific needs.